Journey towards savings

Get started on the path towards more green in your pocket, and a greener planet.

Enquire today >

Disclaimers and additional information

This article provides general information only about the vehicle/s, it should not be relied upon. SG Fleet is not the supplier or manufacturer of the vehicle and does not take any responsibility for the vehicle or the information about the vehicle contained in this article. You should make your own independent assessment of the vehicle and other sources of information (including the websites of the vehicle distributor/manufacturer). Vehicle images are for illustration purposes only. The information provided is for the purpose of assisting you with your vehicle selection process only; all orders and delivery times will be subject to stock availability. With global supply issues affecting the auto industry, wait times may be longer than usual. Electric Car Exemption Disclaimer

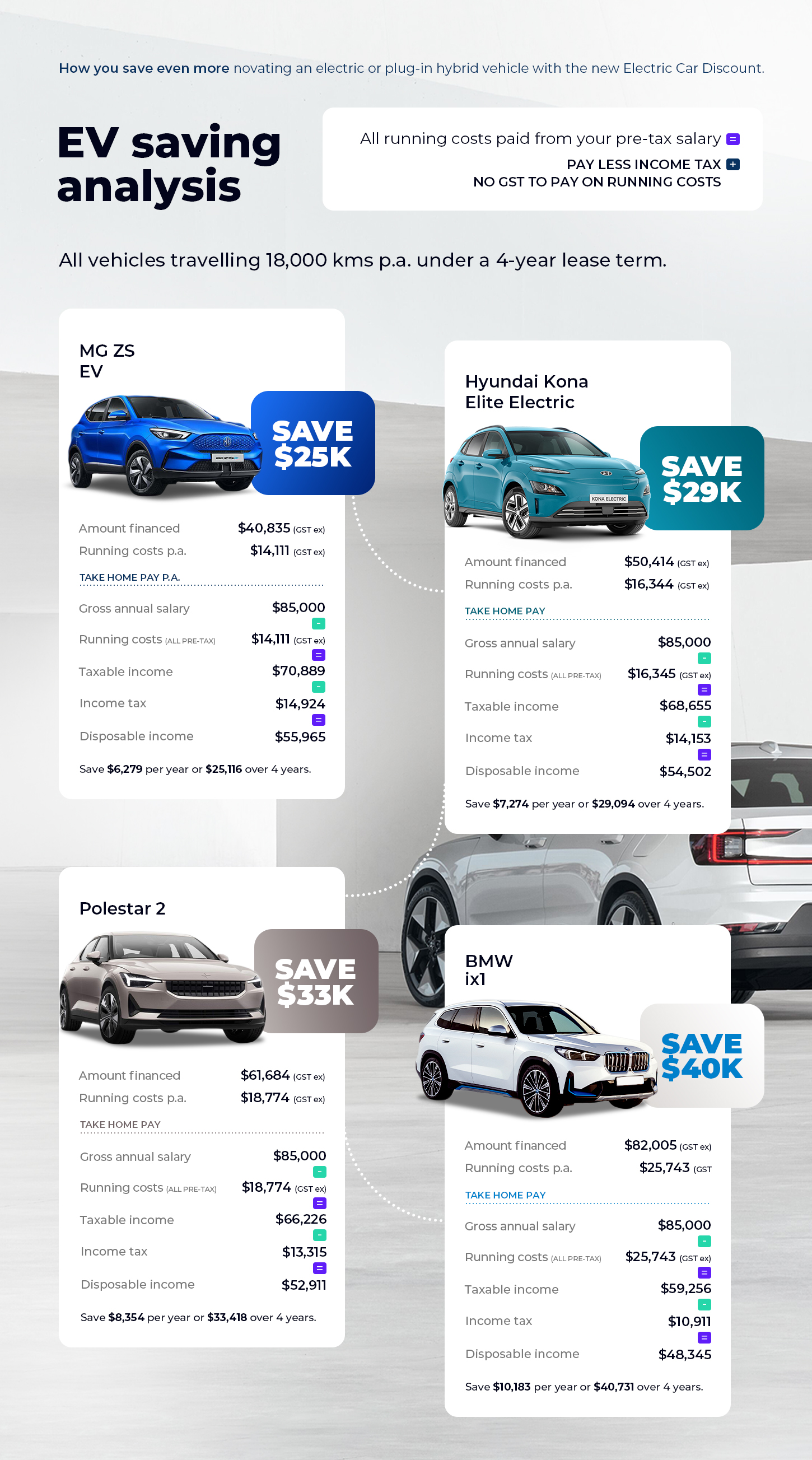

The Treasury Laws Amendment (Electric Car Discount) Act 2022 received Royal Assent on 12 December 2022. Under this enacted legislation certain zero or low emission cars held and used on or after 1 July 2022 will be exempt fringe benefits where provided by an employer to an employee where the first retail sale of the car is below the prevailing luxury car threshold for fuel efficient cars which is currently $89,332. Further limited guidance on the application of the above exemption can be found on the ATO website. A Customer considering entering into a novated lease for an electric car should seek their own independent tax, financial and legal advice regarding any proposed arrangement including the impact of such an arrangement from a salary sacrifice and reportable fringe benefits perspective. SG Fleet Group is not providing the Customer with legal, tax and financial advice regarding the purchase and financing of an electric car. Novated Lease Comparison

^Novated lease comparison based on 2022-2023 income tax rates. The examples given within this material are provided for your information and to illustrate scenarios. The results should not be taken as a substitute for independent professional taxation and financial advice. For the purposes of this example we have not taken into account the impact of salary sacrificing gross salary for fringe benefits on the calculation of your superannuation guarantee contributions. This calculation also does not take into account the impact of any tax offset such as the lower and middle income tax offset to which you may be entitled to. All reasonable care has been taken in preparing these materials; however, SG Fleet provides no warranties and makes no representation that the information provided is appropriate for your particular circumstances or indicates you should follow a particular course of action.